Understanding Closing Costs in Pennsylvania

At Hometowne Realty Professionals, we help buyers and sellers throughout Lancaster County navigate every step of the real estate process, including understanding closing costs in Pennsylvania. Closing costs are an essential part of any real estate transaction, yet they often come as a surprise to first-time buyers and even seasoned sellers.

Whether you are preparing to purchase a home or planning to sell, knowing what closing costs include and how they are calculated allows you to budget accurately and avoid last-minute stress. Our experienced agents provide clear guidance so you can move forward with confidence.

New Paragraph

What Are Closing Costs in Pennsylvania?

Closing costs are the fees and expenses paid at the final stage of a real estate transaction when ownership is officially transferred. In Pennsylvania, both buyers and sellers have closing costs, though the types of costs and who pays them can vary depending on the agreement.

These costs typically cover lender fees, title services, taxes, insurance, and administrative expenses required to legally complete the transaction.

Common Closing Costs for Homebuyers in Pennsylvania

Buyers in Lancaster County should expect closing costs to range between 2 percent and 5 percent of the home’s purchase price, depending on the loan type and transaction details.

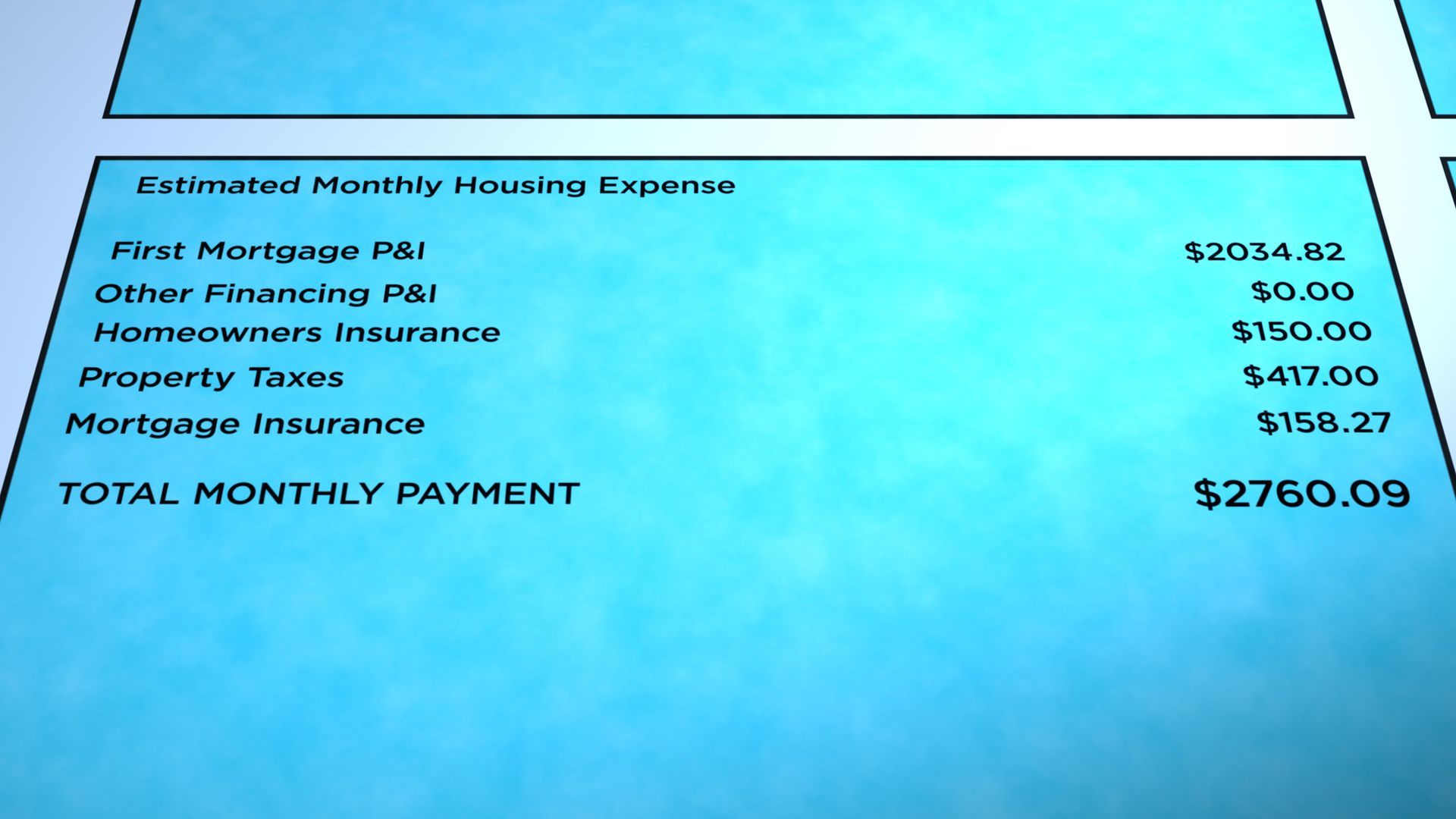

Common buyer closing costs include:

- Loan origination and lender fees

- Appraisal and credit report fees

- Title search and title insurance

- Homeowners insurance premium

- Prepaid property taxes and escrow deposits

- Recording fees and administrative costs

Your lender will provide a Loan Estimate outlining these costs early in the process so there are no surprises at closing.

Common Closing Costs for Home Sellers in Pennsylvania

Sellers also have financial responsibilities at closing, most commonly related to transferring ownership and paying professional services.

Typical seller closing costs include:

- Real estate agent commissions

- Transfer taxes (commonly split between buyer and seller in Pennsylvania unless negotiated otherwise)

- Title insurance (seller’s policy in many transactions)

- Outstanding property taxes or utility balances

- Attorney or administrative fees, if applicable

Understanding these costs ahead of time allows sellers to accurately calculate net proceeds from the sale.

Can Closing Costs Be Negotiated?

Yes, many closing costs in Pennsylvania are negotiable. Depending on market conditions, buyers may ask sellers for closing cost assistance, or sellers may offer concessions to attract strong offers.

Our agents at

Hometowne Realty Professionals help you evaluate negotiation strategies based on current Lancaster County market trends, ensuring your interests are protected while keeping the transaction competitive.

Why Understanding Closing Costs Matters

Being informed about closing costs helps you:

- Budget accurately and avoid unexpected expenses

- Compare loan offers more effectively

- Make stronger, more confident offers

- Understand your true financial commitment

Preparation reduces stress and allows the closing process to move smoothly and efficiently.

Why Choose Hometowne Realty Professionals?

Local Expertise – We understand Pennsylvania closing practices and Lancaster County regulations.

Clear Communication – We explain costs in plain language so you always know what to expect.

Buyer and Seller Advocacy – Our team works to protect your financial interests throughout the transaction.

Full-Service Support – From contract to closing, we guide you every step of the way.

Ready to Plan for Closing Day?

If you are buying or selling a home in Lancaster County, understanding closing costs is key to a smooth transaction. Hometowne Realty Professionals is here to help you review estimates, prepare financially, and close with confidence.

Contact us today to discuss your real estate goals and get personalized guidance on closing costs in Pennsylvania.