Property investments can be a game-changer. They offer a path to financial freedom and a secure future.

But where do you start? How do you navigate the complex world of real estate?

This guide is here to help. It will break down property investments for beginners and seasoned investors alike.

We'll explore different types of property investments and strategies. We'll delve into the benefits and risks, and how to manage them.

You'll learn about property management, investment calculators, and the best cities for property investment.

By the end, you'll have a solid understanding of property investments and how to make them work for you.

Understanding Property Investments

Property investments involve buying real estate with the intention of making a profit. This could be through rental income, the future resale of the property, or both.

It's a tangible asset that can provide steady

cash flow and potential appreciation over time. But like any investment, it comes with its own set of risks and challenges. Understanding these is key to successful property investing.

The Benefits of Property Investments

Investing in property can offer several benefits. One of the main advantages is the potential for steady cash flow through rental income. This can provide a consistent source of revenue, especially if the property is in a high-demand area.

Additionally, property investments can appreciate over time, increasing your wealth. They also offer tax benefits, such as deductions on

mortgage interest, property taxes, and operating expenses. Plus, real estate can serve as a hedge against inflation, as property values and rents often increase with inflation.

Photo By: Equity Multiple

Types of Property Investments

There are several types of property investments, each with its own potential benefits and challenges. The type you choose will depend on your investment goals, risk tolerance, and resources.

- Residential: This includes single-family homes, apartments, townhouses, and vacation properties. Residential properties can provide steady rental income and potential appreciation. However, they require active management and maintenance.

- Commercial: These are properties used for business purposes, such as office buildings, retail stores, and restaurants. Commercial properties often have longer lease agreements, providing more stable income. But they can be more expensive to buy and maintain.

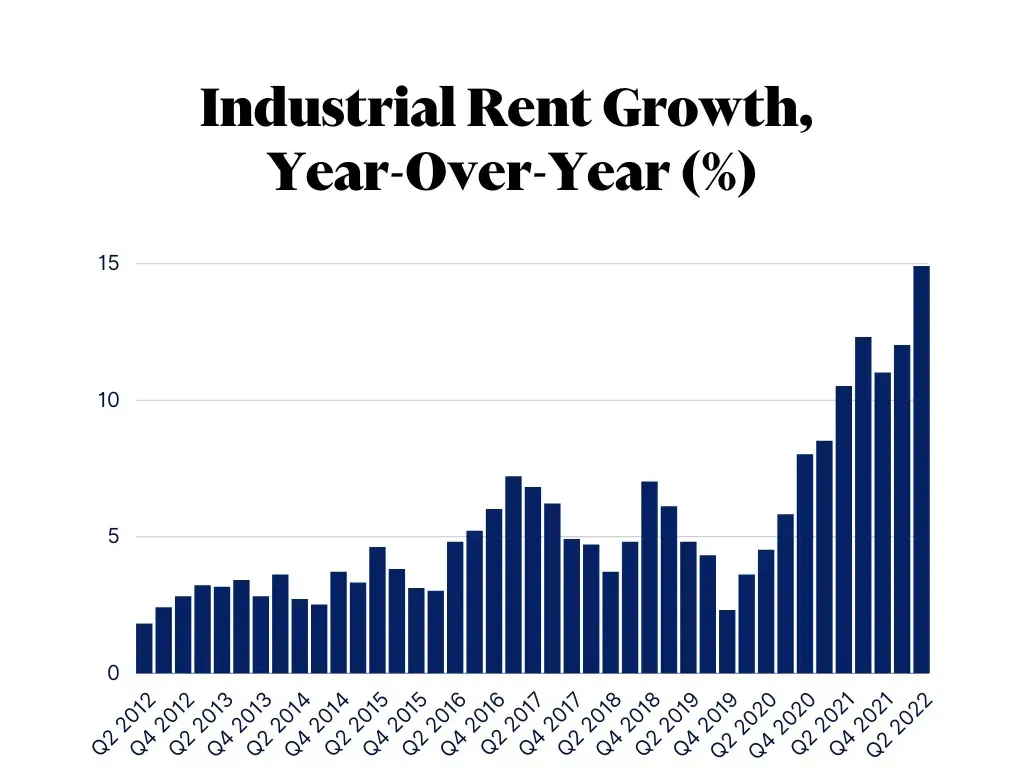

- Industrial: This category includes warehouses, factories, and distribution centers. Industrial properties can offer high returns and long-term leases. However, they may be affected more by economic cycles and require a significant initial investment.

Real Estate Investment Strategies

There are numerous strategies to consider when investing in real estate. The right one for you depends on your financial goals, risk tolerance, and time commitment.

One popular strategy is buy-and-hold. This involves purchasing a property and holding onto it for a long period, benefiting from both rental income and property appreciation. It's a long-term strategy that requires patience but can yield significant returns.

Another strategy is flipping properties. This involves buying a property, improving it through renovations, and selling it for a profit. It's a more active strategy that requires a good understanding of the real estate market and renovation costs. It can be risky, but it can also provide quick returns if done correctly.

Passive vs. Active Real Estate Investing

Passive real estate investing involves purchasing properties and holding them for the long term. The goal is to generate income through rent and benefit from property appreciation over time. This strategy requires less day-to-day involvement, making it a good option for investors who want to diversify their portfolio without the need for constant management.

On the other hand, active real estate investing involves a more hands-on approach. This could mean flipping properties, managing rental properties, or developing real estate. While it can be more time-consuming, it also offers the potential for higher returns if managed effectively.

Is Real Estate Worth It?

Investing in real estate can be a worthwhile venture, but it's not without its challenges. The potential for steady cash flow, tax benefits, and property appreciation make it an attractive investment option. Moreover, real estate can act as a hedge against inflation, maintaining its value even during economic downturns.

However, it's important to remember that real estate investing requires a significant amount of time, effort, and capital. It also carries risks, such as property damage, market fluctuations, and problematic tenants. Therefore, it's crucial to conduct thorough research and due diligence before diving in.

How to Start Investing with Little or No Money

Breaking into the real estate market might seem daunting, especially if you're strapped for cash. However, there are strategies to start investing with little or no money. One popular method is through real estate investment trusts (REITs), which allow you to invest in property without the need for a large capital outlay.

Another option is to use creative financing strategies, such as seller financing or lease options. These methods can help you acquire properties without a large down payment. However, they require a good understanding of real estate transactions and legal implications, so it's advisable to seek professional advice.

Photo By: Rocket

Property Management for Investors

Property management is a crucial aspect of real estate investing. It involves the oversight and operation of real estate properties, ensuring they're well-maintained, tenanted, and profitable. Good property management can significantly increase the value of your investment over time.

Investors can choose to manage their properties themselves or hire a professional property management company. While self-management can save costs, it requires time, effort, and knowledge of landlord-tenant laws. On the other hand, hiring professionals can provide expertise and free up your time, but it comes at a cost. It's essential to weigh these factors when making your decision.

Utilizing Property Investment Calculators

Property investment calculators are valuable tools for investors. They help analyze potential deals by calculating key metrics like return on investment, cash flow, and capitalization rate. By inputting property price, rental income, and expenses, you can get a clear picture of a property's profitability before making an investment decision.

Best Cities for Property Investment

Choosing the right city for property investment can significantly impact your returns. Factors such as economic growth, job market, population growth, and rental demand should be considered.

Cities with a

strong economy and

growing job market often attract more people, increasing the demand for rental properties. Researching these factors can help you identify the best cities for property investment.

Conclusion: Taking the Next Steps in Property Investment

At Hometowne Realty Professionals, we understand that property investment can be a rewarding venture when approached with the right knowledge and strategy. As experienced realtors, we are dedicated to guiding you through every step of the process, whether you're a beginner or an established investor. Continuous learning and staying updated with market trends is vital for achieving success in real estate.

Every successful investor starts with that critical first step. If you're ready to take yours, or if you need expert advice tailored to your investment goals,

contact us today. Our team of professionals is here to support you in navigating the real estate market and making informed decisions that will lead to your financial success.